Table of Contents

Home equity loan

What is a home equity loan? Specifically, a home equity loan is a loan. It allows you to take a percentage of your home or your property value as a loan.

What does a home equity loan give us?

A loan means to take an amount of money from someone or an institution. Then give the amount of money back within a specific period. So, what is a home equity loan? What benefits does it fill us with? Is it feasible? Is it financially friendly? The description of this topic is here in the below elucidation. Naturally, like everything, this loan has advantages and disadvantages also.

It stands for a type of loan where people take a loan with the help of property equity. Equity stands for the value of the owner’s property dividends in his property. And a loan is anything you will borrow in the form of money from an institution or individual. An Example of your property is your home. Here the equity is the interest of your home or your property.

In other words, it’s a loan where you can keep your house or property as a mortgage for the loan. Then take a share/equity of your asset as a loan. For example, your investment costs $100000, and you can take 85% of that amount, i.e., 85000 as a loan, and fill this debt with installments in a specific amount of time.

What is a second mortgage?

The second mortgage is a mortgage that is a proxy for another mortgage, which helps you to fill your primary mortgage. It is a loan where the owner takes with the insertion of his first mortgage. And he takes a loan from the equity of his property, which everyone calls a secondary mortgage. A second mortgage is usually feasible in many ways.

For instance, a person wants to fill his home loan. Where the property as collateral. The second mortgage can help here.

Undoubtedly a second mortgage is coherent and useful for overcoming primary debts. As said, a second mortgage can be efficient in subsisting home loans. Crowds sometimes use it in case of liquidation of any organization. They are keeping the institution property as a pledge for the loan. And actually, the second mortgage works more efficiently in these cases. However, everyone should handle this type of loans carefully as we know everything has pros and cons.

How does the second mortgage and what is a home equity loan relate?

The most significant advantage of owning a property is that you can ameliorate its equity as time passes. People sometimes call a second mortgage a home equity loan. A home loan is where you can keep your property as collateral. And then take money to edifice your home. But then you get to find out that the given interests are high and hard to fill. Now you can take the help of a second mortgage or home equity loan.

The person who borrowed the money has to repay the debt within a specific amount of time in installments created up of a part of the working capital amount and interest payments. As time passes, the person fills his loan and secures his primary mortgage.

Now, if anyone needs a loan to renovate his home or his property or pay the college fees of his children, he can take a home equity loan as stated. In the same way as the first mortgage. In light of his previous records and use them to fill his desired needs.

HELOC

HELOC positions for a home equity line of credit; it’s a bit different from a home equity loan. It works and functions like a credit card on which you can have your accessibility. Lenders give shifting types of processes on the accessibility of those amounts. Most of the time, the banks offer reasonable interest rates, which’s a good advantage. Writing a check, online transfers, and credit cards linked to your bank account access the money in a realizable way.

So this HELOC allows you to lend an optimized value of money within a given part of the time. Also, here the mortgage is the equity of your property or your home. But here, you might need to acquire enough homeowner insurance to cover the debts other than balancing the money on the go. HELOC works like a credit card as we all know credit cards are quite efficient in most cases, as for home equity loans, where you get the real money at one time. But in HELOC, you can use it by taking small amounts or using it as credit cards.

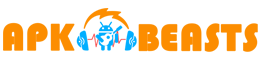

Difference between HELOC and what is a Home Equity Loan

Here is a home equity loan you can attain the whole amount of money in one go and pay that debt within a specific period with a fixed interest rate. For example, if your equity costs $100, and you apply for a home equity loan in a bank, and they offer you 85% of your equity, so you get $85, you can take that amount of money in whole go.

In comparison to home equity loans, HELOC stands for a home equity line of credit. In HELOC, you can work your equity as a credit card with the property dividend and the property as the mortgage, which is the limit, and fill that loan in installments with interest rates that shift. It is usually a better option when you don’t want to spend the money in whole, but periodically and also as it works as a second mortgage, you can use it to pay your monthly needs.

Which one should we choose, a Home equity loan or HELOC?

What is a home equity loan? A home equity loan utilizes your equity as a loan. The interest you grow in your property, house, or condo is equity, which you can attain as a loan. It is mainly feasible in case you fill your first mortgage. But here, as your loan is based on your equity value, the interest rates are not that beautiful or, in other words, hard to cope with.

On the contrary, HELOC means home equity line of credit similar to the home equity loan, but the difference is you won’t get a lump sum of money. Instead, you can work that money as a credit card with your equity as collateral. But if your credit scores are low or your income source fluctuates, then possibly you won’t get that facility.

So in light of the description, it can be said that if you can cope with the interest of a home equity loan, then it’s a great practical way. It is also if your credit scores or your income source is right, then HELOC is suitable for you.

What is a Home equity loan advantages

There are many precedence and uses of home equity loans. For instance, you developed your condo by taking a home loan from a lender or bank by keeping your property as a mortgage. And now you have to fill that loan. Here the home loan is a primary mortgage. Here comes the need for a home equity loan where you can keep your developed home as a mortgage after building suitable equity. It is a second mortgage. A home equity loan is a secondary mortgage that you can use to fill your primary mortgage.

So here we can say that home equity loans are best if you have any other type of debts or you want financial help with any kind of cases. In these types of examples, home equity loans are quickly useful if you are happy with the interest rates the lenders or banks to provide

Disadvantages of a equity loan

In this world, everything has disadvantages following its ascendance. It seems likely that home equity loans also have some drawbacks along with feasible advantages. Usually, equity loans come with fixed interest rates. Which are a bit tough for making up compared to the home equity line of credit as they are selected. And the rates won’t change as of HELOC. In HELOC, the rates vary irregularly.

However, if a home equity loan is a burden on your financial base and the interest rate can’t keep up with your regular incomes, then a home equity loan is going to be a significant problem for you in the end. Home equity loans may seem very tasteful as a subordinate to fill your primary loan, but after a few years, if your source of income is not stable, it will have a fair amount of hard times in your life. So, in this case, no one should choose home equity loans if their income sources fluctuate.

What is a equity loan uses

What is a home equity loan? And where can you use it?

Examples of this type of loans used in various fields are below

- In case you want to fill your home loan or any of your concerning debts home equity loan is the right choice by keeping your home as collateral.

- You want your children to be in the right college, but the college fees and tuition fees are sky-high, as you know. But here, you can use your condo as a mortgage and use a home equity loan to fill those fees.

- You took an incredible amount of personal debt, and the rates of interest are high in this case of your primary mortgage, which is hard to have. But if your home equity loan has low-interest rates than the immediate loan, then a home equity loan is efficient.

FAQs

What is a equity loan applying times?

You can get home equity loans equal to the number of properties you own. So if you have 2 to 3 properties, you can use those properties to get an equity loan, i.e., the amount of stuff you own is the number of loans you get.

Our equity loans applicable to anything?

Yes, you can use your loan on anything. After you take out the money, you can use it on anything. But anyone should use it to fill high expenses or to fill debts of any kind. But again, it can be used in any sector as it is your money.

How much equity do you need to have to get a equity loan?

Naturally, you need 15% to 20% equity on your home to apply for a home equity loan. So you can grow the equity of your home to a minimum of 15% to 20%, then the banks may give access to get a home equity loan.

What is the year range for a equity loan?

Usually, it ranges from 5 to 30 years. Within usually a minimum limit of 5 years and a maximum limit of 30 years, you have to fill your debt depending on the amount of money you are taking, and also it depends on the banks.

Do you need to pay taxes for your loan?

Taxes are the part of the money that you have to give to the government, which applies to your income source. As this loan money is different, taxes do not apply to this. So, if you are borrowing money, taxes are not applicable for that money.

What makes you get denied a equity loan?

Regular banks set a limit and justify if your income is within those limits. And also, they see that your primary mortgage is not that big. If you can’t satisfy these conditions, then you might get denied. So your income sources must be stable, and your primary debt must not be ample.

Our home equity loans applicable to those mobile homes?

No home equity loans do not apply to those mobile homes? You need to have land to get home equity loans. But if someone transfers that home to land afterward, then it might work on home equity loans. So home equity loans do not apply to mobile homes.

Should you take a Equity Loan?

So, What is a home equity loan? What are its advantages? Is it feasible? In this illustration, everything is described. If you’re looking for a loan that will in term help you to fix your other loan at higher interest rates, or you need to fill your high monthly expenses and again you want to get rid of your home loan, then a home equity loan is a beautiful settlement. But also, if your income source is not stable, then it’s a wrong move for you, which could make you financially unstable and lose everything with your home and properties.

Many peoples take home equity loans every year and give positive reviews on them, which helped both the customers and the lenders.