Table of Contents

Where is Get My Stimulus Check Status?

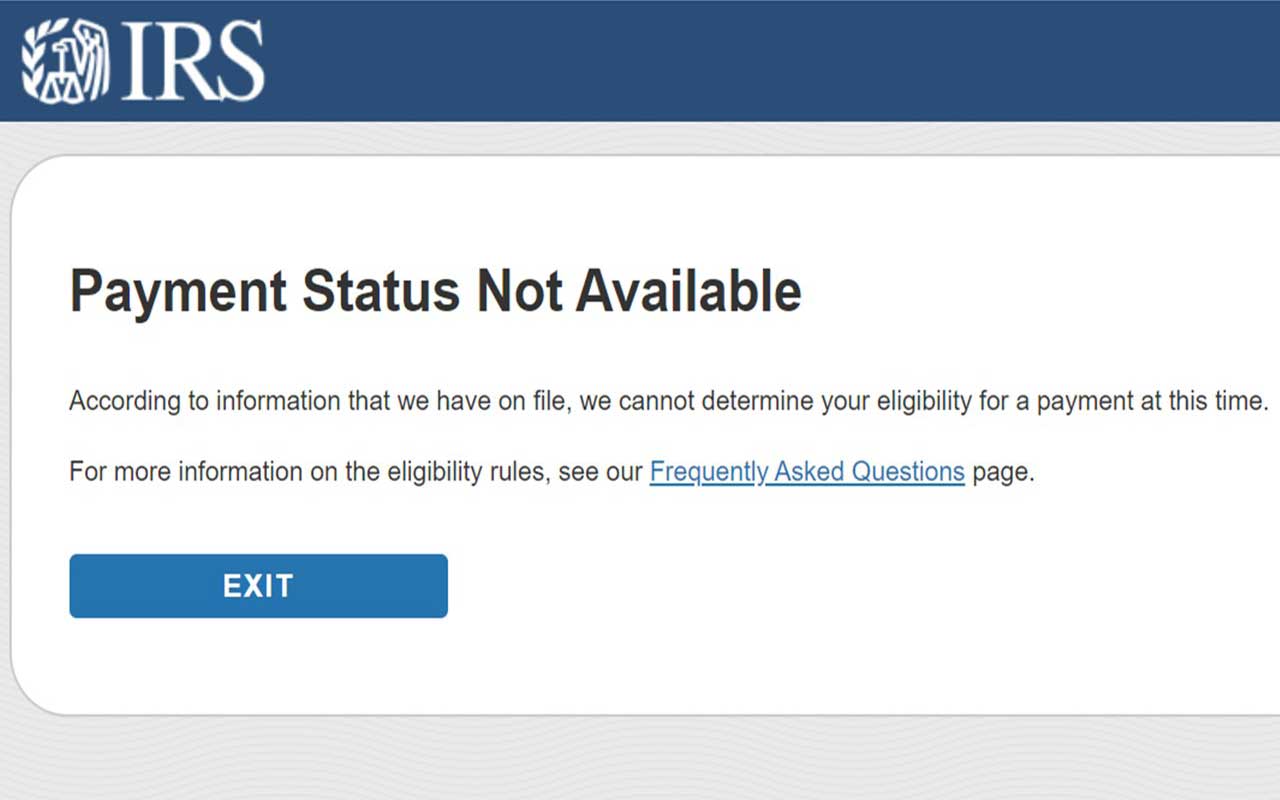

Get My Stimulus Check status-there are several avenues you’ll take, and thus we’ll explain what they’re. But the very initiative we propose is to use the IRS’ payment tracking tool to urge which will data. Eventually, helping guide you, and you recognize what to try to do next. Moreover, it will be that the tools say it mailed a paper check. Or EIP card made an immediate deposit you never got will prompt one course of action. Maybe there is a cryptic message. That means the IRS doesn’t have enough information about you, which will direct you differently.

https://www.youtube.com/watch?v=kUqZCFY4Gog

If the IRS tells, it sent a payment amount that you did receive. Still, you used our get my stimulus check status calculator. And believe you are entitled to more, and a particular error might be the cause. You will get to claim all—besides a part of your missing stimulus payment as Recovery Rebate Credit on your taxes. Thus results, albeit you are a non-filer. Here are some for using the tool and how specific messages can guide you on what to do next. (In other news, here’s what we all know about the timeline of a 3rd stimulus check for up to $1,400.)

IRS Get My Payment: What to understand before using the tool

While the IRS actively sending stimulus checks, it updated its tracking tool, calling Get My Payment, once each day. Thus you connect your Social Security Number, Date of birth, address, and postcode. Finally, the agency displays a message with information. That about your check, whether sent, the payment method (direct deposit or by mail), and the date also. Moreover, it’ll also allow you to know if the service can’t yet determine your status — more below on error messages.

What is the IRS letter confirming your stimulus payment?

If the IRS issues you a get my stimulus check status, it sends a notice by mail to a taxpayer. Finally, known address within 15 days after making the payment to verify deliveries. Then the letter contained information on when and how that made. And how to report back to the IRS if you didn’t receive your check. The letter is useful though you didn’t receive your full payment and wish to say your money later. However, here’s the way to recover the knowledge if you lost or tossed the letter.

It’s not so late to prepare for a third-get my stimulus check status.

A third stimulus check is within the works. And you will likely catch on fastest if you got an immediate time deposit account out with the IRS. If you do not, it isn’t too late, but you’ll get to act early. The IRS did not let people register new direct deposit accounts or change their banking information with the second stimulus check.

Still, not get my stimulus check status?

Tax season is upon us, and with an opportunity to file for any missing stimulus money you are owing. If the second stimulus payment never arrived, you are not alone. Many people experience delays or other issues that have prevented their checks from coming. At the same time, most people will be ready to claim that money on an income tax return as Recovery Rebate Credit.

The first step to working out which course you ought to take is to see the IRS’ payment status tool. Depending on what it tells you, you’ll get to continue to request a Payment Trace. (You can use our get my stimulus check status calculator to estimate the quantity of cash you ought to have received.)

Case The IRS online app says the agency sent your money, but you never received it.

If your second get my stimulus check status is missing, you first attend a free IRS online payment tracking tool calling Get My Payment. That is to seek out its position. We’ve full instructions on how to use the Get My Payment tool. Therefore the different messages you would possibly see here. You will need to connect to the Social Security number. Or Individual Taxpayer number, Date of birth, address, and ZIP or zip Code.

The portal will show payment status if your money has to send. And therefore the payment method (direct deposit or by mail) and date. You would possibly also see a special message or a mistake.

You will need a request for Payment Trace if the Get May Payment portal shows your payment issue. But you did not receive it within these timeframes:

Five days since the deposit date in getting my amount, your bank says they haven’t received it.

Four weeks since it mailing by check to a specific address for the primary review; after 24 February for the second check.

It is six weeks since it is shipping. And you’ve got a forwarding address on file with the local post office for preliminary review; 10 March for the second check.

Nine weeks since its mailing, you’ve got a far-off address for the primary check; 31 March for the double bill.

Case 2: The IRS sent a letter for verifying your payment sent, but the cash did not arrive

If received this letter also called Notice 1444 economic impact payment. But never received your payment, you will need to request a Payment Trace. Confirm you retain the letter. You will need the knowledge to file your claim.

How to request a payment trace with the IRS

- Write “EIP” in the highest shape(EIP stands for Economic Impact Payment)

- Complete the form answering all refund questions as they relate to your payment payment

- When completing item 7 under Section 1:

Check the box for “Individual” because of the sort of return.

Enter “2020” because of the Tax session.

Don’t write anything for the date Filed.

Sign the shape. For married couples and filing together, both spouses must sign the form.

How does the IRS process Payment Trace claims?

The IRS will do the after process your claim, consistent with its website:

- If you didn’t cash the check, the IRS would issue a replacement. If you discover the first check among your belongings, you will return it as soon as possible.

Also

If you probably did cash the refund check, expect a claim package from the Bureau of the Fiscal Service, including a replica of the cashed check. Then, follow the included instructions. The Bureau will review your claim. Therefore, the canceled check’s signature before deciding if they’ll issue a replacement is often to protect against stimulus check fraud.

What is a mixed-status family for stimulus payment?

Here are some samples of mixed-status families that might qualify for a stimulus check. Where a minimum of one household member features a Social Security number:

One spouse may be a US citizen with a Social Security number. And therefore, the other spouse isn’t a citizen and doesn’t have a Social Security number.

One spouse may be a “lawful permanent resident” with a Social Security number. And therefore, the other isn’t a citizen and doesn’t have a Social Security number.

Neither parent may be a US citizen or “lawful permanent resident” with a Social Security number. And a toddler may be a US-born citizen with a security id.

We provide a handy guide laying out the ways non-citizens may and should not qualify for payments.

Which mixed-status households qualified for the primary and second payments? Is that the stimulus money retroactive?

With the primary stimulus check from CARES Act, only with a Social Security number eligible for a payment. This requirement could include “resident aliens” with a Social Security number, the IRS said. But “nonresident aliens” weren’t eligible. Married couples are excluded from checks if one spouse did not have any security id. However, for married couples filed separately, only the spouse with the Social Security number qualified. Dependents during a mixed-status family were also excluded.

With the second check, Congress opened the wants (PDF) to married couples filing jointly. Where one spouse features a Social Security number, and therefore the other spouse doesn’t. A few during a mixed-status household rubbing together would be valid for second payment@ $600.Likewise, each eligible with a Social Security number. If the couple files separately, only the spouse who features a Social Security number would be suitable.

December stimulus bill also made the mixed-status qualifications retroactive for the direct payment. Now an eligible family filing simultaneously can claim missing first-round payments up to $1,200 per couple. And $500 for every qualifying hooked into their taxes this year as a Recovery Rebate Credit.

What would a 3rd get my stimulus check status do for a mixed-status family?

Before working in as president on 20 January, Biden unrolled his $1.9 trillion stimulus package. That proposed a 3rd stimulus check for $1,400 per person. This third round of payments, consistent with the plan (PDF), would expand adult dependents’ eligibility. Those are of previous games of relief. And every one mixed-status household.

Biden and his administration did not provide details.

Moreover, during the rollout, he included within the expansion.

While we wait to listen, the newest on the timeline for 3rd stimulus check. And the way money your household could expect to receive with $1,400 payment.

Whatever the reason, if you are missing any money.

Eventually, you’ll claim your full stimulus check amount as a Recovery Rebate Credit on your tax return. And this credit joints your stimulus money with an income tax return. While you will not get a separate check, you’ll get either a bigger tax refund or pay the smaller bill. (If you’ve got any outstanding debts, the IRS could potentially garnish some or all of your refund to pay them.) We recommend filling your taxes as soon as possible and signing up for a direct deposit.

For starting the Recovery Rebate Credit claim process, you should first confirm your payment status online through the IRS. If you see a confusing message or possible error, you’ll be a candidate for a rebate or a payment trace. Note there could also be additional steps if you’re filing a tax extension. Here’s everything you would like to understand about filing for a Recovery Rebate Credit. And this is often what we all know a few third stimulus checks. Thus including what proportion of money you’ll get, the conversation around “targeted” statements. And the way fast a 3rd stimulus payment might arrive.

What if my get my stimulus check status accidentally garnishes

Although there are cases where the federal or debt collector could seize your first payment to hide any outstanding debt, generally, if you qualify for a get my stimulus check status, it’s yours to spend or save as you would like. One area where the federal can garnish your first stimulus check is for overdue support payment. However, if the oldsters separate or divorced, only the spouse who owes support payment should have the bill seized.

According to IRS, the parent who doesn’t owe support payment should receive their direct payment portion without requiring action. If you have not received your check, the IRS says it’s working to send the missing amounts. While you do not have recourse to appeal IRS decisions, you to try the Non-Filers tool to make a record of the claim.

Final Words

Thus finally, we are here, all about to get my stimulus check status. You can go through the article and have experienced also.